Have been collected by FinanceBuzz editors.

This secured card is worth considering if you want to rebuild your credit.ĭetails about Capital One Platinum Secured Credit Card, Capital One Platinum Credit Card You can also get consideration for a credit line increase in as few as six months, and you have the option to pick your monthly due date. This card has a $0 annual fee and only requires an initial security deposit of $200.

#Indigocard reviews free#

The card also has many more conveniences and benefits, including a mobile app, extended warranty protection, no foreign transaction fees, no liability for fraudulent charges, an auto liability waiver for rental cars, and free credit monitoring.Īlso from Capital One is the popular secured credit card: the Capital One Platinum Secured Credit Card.

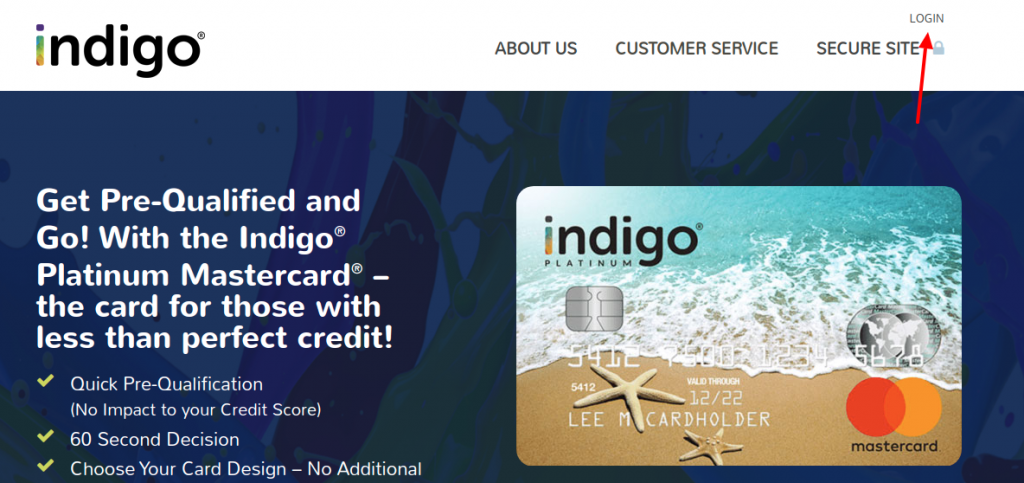

This card has a $0 annual fee and you get automatic consideration for a credit line increase in as few as six months after account opening. The Capital One Platinum Credit Card is a great choice for students, those looking to establish or build a credit history, or even those who may have some loan defaults or other blemishes on their credit reports. Some other credit cards that can help you build credit include: The Indigo MasterCard is decent - especially if you can qualify for the $0 annual fee - but may not always be the optimal choice for those looking to build their credit profile. You can use your mobile device to access your account through the Indigo Account Management site 24/7.

#Indigocard reviews android#

There is currently no Indigo Mastercard mobile app in either the Android or Apple app stores. With some time, responsible spending, and on-time payments, your scores could steadily improve. This ensures that all three of your scores are affected by your use of the card.

#Indigocard reviews full#

You get a decision in seconds with the option to move on to a full application. You’re asked to enter basic information, including contact info and Social Security number. Indigo requires all applicants to prequalify before they will process the application.

The better your credit, the better your chances of getting a $0 fee. Upon approval, you could be assigned an annual fee of $99 ($75 the first year), $59, or $0.

0 kommentar(er)

0 kommentar(er)